Your values, your wealth—comprehensive services for a happier life.

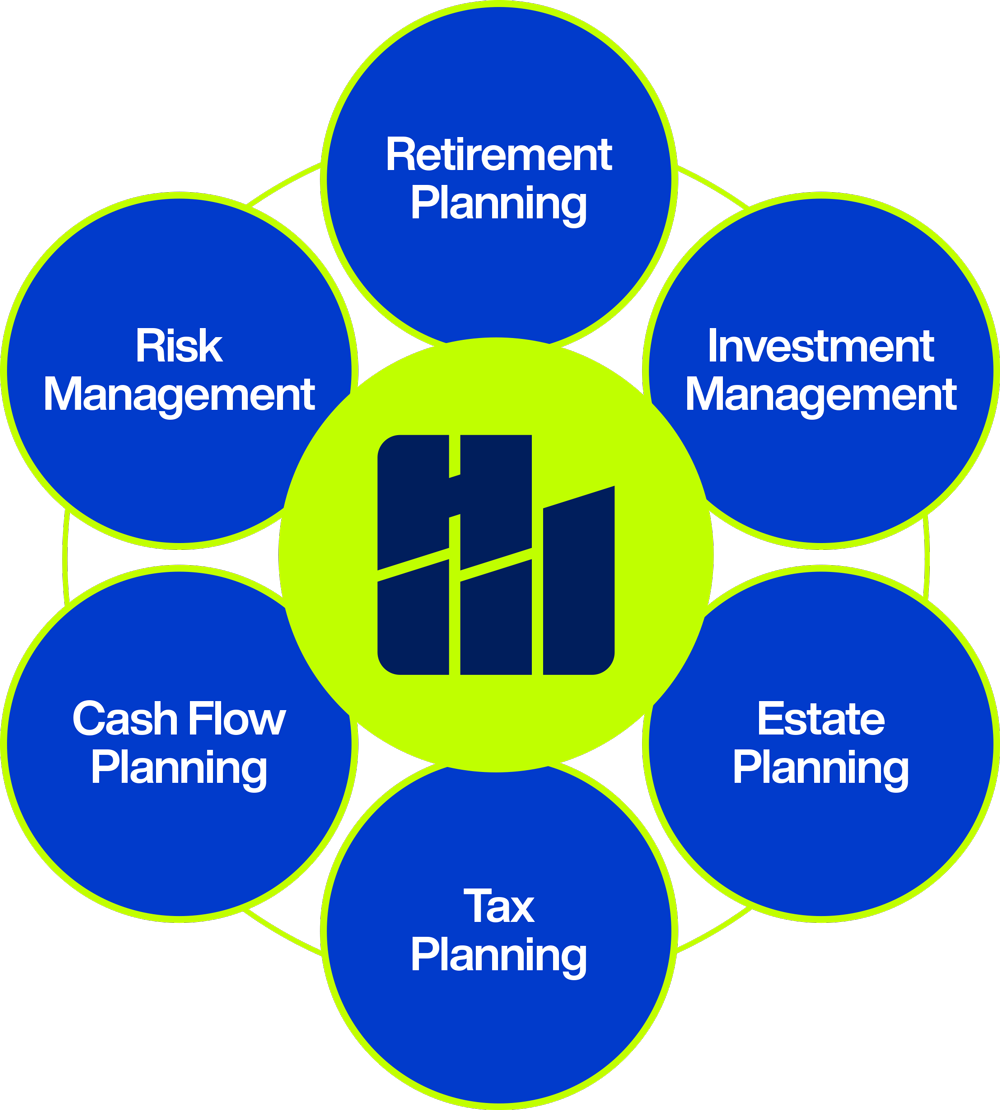

At Happier Wealth, we provide a comprehensive range of financial advisory services tailored to guide you through every phase of your financial journey, crafting personalized strategies that harmonize with your core values and life goals. Whether you’re preparing for retirement, managing your investments, or fine-tuning your tax strategy, we ensure that each aspect of your financial plan supports your vision of happiness and security. From thoughtful cash flow planning to detailed estate and insurance reviews, our commitment is to deliver solutions that enhance your well-being and align with what truly matters to you. Get Started

Retirement Planning

Designing Your Path to a Secure and Fulfilling Future

Retirement is a significant life transition, and at Happier Wealth, we believe it should be a time of fulfillment, not financial worry. Our retirement planning services focus on providing you with a tailored roadmap that ensures financial stability and supports the lifestyle you envision. Whether you’re decades away from retirement or it’s just around the corner, our approach to retirement planning is designed to help you pursue financial freedom.

Key Components of Our Retirement Planning Services

- Understanding Your Retirement Vision: We begin by helping you define your vision of retirement. Do you plan to travel, pursue hobbies, volunteer, or spend more time with family? Understanding your desired lifestyle helps us create a plan that aligns with your goals.

- Comprehensive Retirement Needs Analysis: Our retirement planning process includes a detailed analysis of your financial needs in retirement. This involves estimating expenses, including daily living costs, healthcare, travel, and any other specific plans you may have. We consider inflation, market conditions, and life expectancy to ensure your retirement plan is comprehensive and realistic.

- Income Planning Strategies: Generating a stable income in retirement is crucial. We work with you to develop a multi-faceted income strategy that may include Social Security, pensions, real estate, retirement accounts (such as IRAs and 401(k)s), and other income sources. Our goal is to create a reliable income stream that lasts throughout your retirement years.

- Social Security Optimization: Timing is everything when it comes to Social Security benefits. We provide guidance on when to start taking benefits to balance maximizing lifetime income and using income when it’s needed most. We help you understand the impact of different claiming strategies based on your unique situation, ensuring you make the most of what you’re entitled to.

- Tax-Efficient Withdrawal Strategies: Withdrawals from retirement accounts need to be managed carefully to avoid unnecessary taxes and penalties. We develop tax-efficient withdrawal strategies to help you minimize your tax liability while maintaining the income you need.

- Risk Management in Retirement: Protecting your retirement savings from unexpected events is essential. We help you assess risks such as market volatility, longevity risk (the risk of outliving your assets), and healthcare costs. Our strategies may include annuities, insurance products, or diversifying income sources to safeguard your financial future.

- Healthcare and Long-Term Care Planning: Healthcare can be one of the most significant expenses in retirement. We work with you and your healthcare advisor(s) to estimate potential healthcare costs, including Medicare and supplemental insurance options, as well as planning for long-term care. This ensures that your retirement plan accounts for these critical expenses without compromising your financial stability.

- Legacy Planning: Many clients want to leave a legacy for their loved ones or support charitable causes. We integrate estate planning into your retirement strategy to ensure your assets are distributed according to your wishes, in a tax-efficient manner, and with minimal legal complications.

- Regular Reviews and Adjustments: Retirement planning is not a one-time event. We conduct regular reviews of your retirement plan to account for changes in your financial situation, market conditions, or personal goals. This proactive approach ensures your plan remains aligned with your needs and can adapt to any life changes.

Retirement should be a time to enjoy the fruits of your labor, not worry about finances. At Happier Wealth, our comprehensive retirement planning services are designed to provide you with a secure financial future that supports a fulfilling and meaningful retirement. We work with you every step of the way to ensure your retirement years are as enjoyable and stress-free as possible.

Investment Management

Building Portfolios That Reflect Your Goals and Values

At Happier Wealth, our investment management approach is all about aligning your portfolio with your unique life stage, comfort with market fluctuations, and financial goals. We believe in using sound investment principles, such as Modern Portfolio Theory (MPT), to construct diversified portfolios designed to balance risk and return. Investing isn’t one-size-fits-all; it’s about creating a strategy that evolves with you—whether you’re building wealth for the future, preparing for retirement, or making the most of your retirement savings.

By taking a personalized approach, we ensure that your investments reflect your time horizon and preferences, helping you navigate market fluctuations with confidence. Our goal is to manage your investments in a way that supports your long-term happiness and financial well-being, so you can focus on enjoying life while we handle the details.

Comprehensive Investment Strategies

Our investment management services include a wide range of strategies and investment vehicles to ensure your portfolio is well-positioned to meet your financial objectives:

- Stocks and Bonds: We offer carefully selected individual stocks and bonds to help you build a strong core portfolio that aligns with your risk tolerance and investment goals. This traditional approach focuses on growth and income, balancing stability with potential for appreciation.

- Tax-Efficient Investing: We integrate tax-efficient strategies into your portfolio management, including tax-loss harvesting and placement of investments in the most tax-advantageous accounts to minimize your tax burden and maximize your after-tax returns.

- Separately Managed Accounts (SMAs): We offer SMAs for clients who desire a more customized investment approach. SMAs provide direct ownership of securities within a professionally managed portfolio, allowing for personalized tax management, gifting, in-kind, tailored investment strategies, and greater flexibility in meeting specific financial goals.

Ongoing Portfolio Management

Your financial situation and market conditions can change over time, and so should your investment strategy. We provide ongoing portfolio management services, including:

- Risk Assessment and Adjustment: Regularly reviewing and adjusting your portfolio to ensure it continues to align with your evolving risk tolerance and financial goals.

- Performance Monitoring: Tracking the performance of your investments and making necessary adjustments to stay on track with your objectives.

- Market Analysis: Staying informed about market trends and economic conditions to make informed decisions and capitalize on opportunities.

A Partnership for Your Financial Future

Our investment management philosophy is rooted in a deep understanding of your personal circumstances and aspirations. We continuously monitor your portfolio, adapting your strategy as your needs and market conditions change. With Happier Wealth, you’re not just investing in the markets—you’re investing in a strategy designed to support your life’s journey and bring you closer to your financial dreams.

Tax Planning

Strategic Approaches to Preserve Your Wealth

At Happier Wealth, we understand that effective tax planning is more than just a yearly task—it’s a proactive, ongoing strategy designed to preserve your wealth and enhance your financial well-being. Our approach to tax planning is built on the principles of optimizing your tax efficiency at every stage of life, aligning your tax strategies with your long-term financial goals to ensure you keep more of what you’ve earned.

Comprehensive Tax Strategies

Our tax planning services focus on strategic guidance that extends far beyond the scope of basic tax preparation. We provide a comprehensive suite of strategies designed to minimize your tax liability and maximize your after-tax income, including:

- Tax-Advantaged Accounts: We help you make the most of tax-advantaged accounts, such as 401(k)s, IRAs, Roth IRAs, 529 plans, and Health Savings Accounts (HSAs). By strategically funding these accounts, including Roth Conversions, we can help reduce your taxable income today, provide for tax-deferred growth, and/or create tax-free distributions.

- Income Distribution Planning: For retirees, managing when and how to withdraw funds from various accounts can significantly impact your tax bill. We develop personalized distribution strategies that consider the tax implications of withdrawals from taxable, tax-deferred, and tax-free accounts, optimizing your income stream to minimize taxes throughout your life.

- Capital Gains Management: We advise on managing capital gains by strategically realizing gains and losses, using techniques like tax-loss harvesting and gain deferral. This approach helps reduce your tax burden while keeping your investment strategy aligned with your financial goals.

- Charitable Giving Strategies: For clients interested in philanthropy, we offer tax-efficient charitable giving strategies, such as donating appreciated securities in-kind, setting up Donor Advised Funds (DAFs), gifting Qualified Charitable Distributions (QCDs) or establishing charitable remainder trusts. These strategies can provide substantial tax benefits while supporting the causes you care about.

- Estate Tax Planning: While estate tax planning is a distinct service, it closely aligns with tax planning. We help clients plan for potential estate taxes by utilizing strategies like gifting, trusts (both revocable and irrevocable), and other tools to reduce the taxable value of your estate and ensure your wealth is transferred efficiently to your heirs.

- Tax-Efficient Investing: We incorporate tax-efficient investment strategies into your portfolio management, including selecting tax-advantaged municipal bonds, utilizing tax-efficient mutual funds and ETFs, and strategically placing investments in tax-advantaged or taxable accounts to minimize your tax liability. Additionally, we use separately managed accounts (SMAs) to provide tailored investment strategies that consider your specific tax situation, allowing for more precise control over capital gains and losses.

Proactive and Personalized Tax Planning

Our tax planning process is not a one-time event but a continuous partnership. We stay up-to-date on the latest tax laws and regulations, ensuring that your tax strategy evolves with changes in your life and the tax landscape. We also work in conjunction with your CPA or tax professional to ensure that your tax planning is comprehensive and cohesive.

By adopting a proactive approach to tax planning, we help you navigate complex tax issues, enhance your well-being and focus on what truly matters: enjoying your life and achieving your financial aspirations.

Estate Planning

Estate planning is crucial for ensuring that your wishes are honored and that your legacy aligns with your values. At Happier Wealth, we guide you in developing a comprehensive estate strategy that complements your financial goals and supports your loved ones. We work closely with your estate planning attorney to craft a strategy that helps minimize tax impacts and facilitates the smooth transfer of your assets. Our aim is to provide confidence by helping you create a plan that reflects what matters most to you and supports your long-term happiness and security. In addition, we focus on helping you pass your values to heirs and not just money alone.

Risk Management

Protecting Your Financial Well-Being

At Happier Wealth, we believe that effective risk management is a cornerstone of any robust financial plan. Life is full of uncertainties, and protecting what you’ve built requires a thoughtful approach that aligns with your unique circumstances and future goals. Our risk management strategies are designed to preserve your wealth from unforeseen events and to provide confidence, allowing you to focus on living the life you envision.

Comprehensive Risk Management Strategies

Our approach to risk management encompasses a variety of strategies and solutions tailored to your specific needs, ensuring that you’re prepared for whatever life may bring:

- Insurance Planning: Insurance is a key component of any risk management plan. We work with you to evaluate and select the right types and levels of insurance coverage, including life, disability, long-term care, and property and casualty insurance. By ensuring adequate coverage, we seek to help protect you and your loved ones from financial hardships caused by unexpected events.

- Life Insurance: Whether you’re looking to provide for your family in the event of your passing, create a tax-efficient inheritance, or fund estate taxes, life insurance is a versatile tool in financial planning. We help determine the appropriate type and amount of life insurance—be it term, whole, variable, or universal life insurance—based on your goals and circumstances.

- Disability Insurance: Your ability to earn an income is one of your most valuable assets. We guide you in choosing the right disability insurance policy to protect against loss of income due to illness or injury, ensuring that you can maintain your lifestyle and meet your financial obligations even if you are unable to work.

- Long-Term Care Planning: As we age, the likelihood of needing long-term care increases. We help you plan for potential long-term care needs, exploring options such as traditional long-term care insurance, hybrid life insurance policies with long-term care riders, or self-funding strategies. This proactive approach helps safeguard your assets and ensures you receive the care you need without compromising your financial security.

- Liability Protection: We assess your exposure to liability risks and recommend appropriate measures to protect your assets. This may include increasing umbrella liability coverage, reviewing homeowner’s and auto insurance policies, and implementing legal structures, such as trusts or limited liability companies (LLCs), to shield personal assets from potential lawsuits.

- Health Insurance Optimization: Health care costs can be a significant burden, especially in retirement. We can help you navigate the complexities of health insurance options, including Medicare and supplemental policies, ensuring you have the appropriate coverage to protect against high medical costs without overpaying for unnecessary coverage.

- Asset Protection Strategies: Protecting your assets from creditors, lawsuits, and other potential threats is crucial to maintaining financial stability. We advise on strategies such as titling of assets, trusts, and other legal structures to help safeguard your wealth from unforeseen claims.

- Income Diversification: To manage the risk of income disruption, we explore strategies to diversify your income sources, such as investing in income-generating assets or creating a passive income stream. This approach helps mitigate the impact of economic downturns or job loss, providing a more stable financial foundation.

Proactive and Personalized Risk Management

Our risk management process is tailored to your unique situation, considering factors like your family dynamics, career, health, and overall financial picture. We work closely with you to identify potential risks and implement strategies to mitigate them, ensuring that your financial plan is resilient against life’s uncertainties. By taking a proactive and comprehensive approach, we help you navigate risks confidently, safeguarding your path to long-term happiness and financial well-being.

Cash Flow Planning

Creating a Roadmap for Your Financial Well-being

At Happier Wealth, we understand that managing your cash flow is a critical component of achieving your financial goals. Our cash flow planning services are designed to provide a clear picture of your income and expenses, helping you make informed decisions that reflect your values and priorities.

Key Components of Our Cash Flow Planning

- Income Analysis: We start by thoroughly analyzing all sources of your income, including salaries, business revenues, rental incomes, and investment returns. Understanding the full scope of your income helps us create a realistic plan tailored to your unique situation.

- Expense Management: Our approach to expense management goes beyond tracking spending. We help you categorize expenses into essential and discretionary spending, aligning your spending habits with your long-term goals. This process helps identify areas where you can save without sacrificing what matters most to you.

- Cash Flow Projections: We create detailed cash flow projections to anticipate future income and expenses. This forward-looking approach allows us to prepare for life’s expected and unexpected events, ensuring your cash flow remains positive and aligned with your financial plan.

- Debt Management: Effective cash flow planning includes managing and strategically reducing debt. We work with you to develop a debt repayment strategy that minimizes interest payments and prioritizes your financial freedom.

- Emergency Fund Planning: An essential part of cash flow planning is preparing for the unexpected. We help you build and maintain an adequate emergency fund to ensure financial freedom and confidence in case of unforeseen expenses or income disruptions.

- Tax Efficiency: Cash flow planning is not just about managing income and expenses; it also involves optimizing for tax efficiency. Our team helps you understand the tax implications of your cash flow and develop strategies to minimize your tax burden.

- Regular Reviews and Adjustments: Life changes, and so should your financial plan. We conduct regular reviews of your cash flow plan to ensure it continues to meet your evolving needs and goals. This proactive approach allows us to make necessary adjustments and keep you on track.

Our comprehensive cash flow planning services help you create a financial roadmap that aligns with your values and aspirations. By understanding your income, managing expenses, planning for the unexpected, and optimizing for taxes, we ensure that your cash flow supports your journey toward a happier and more fulfilling life.